Is Renting a Single-Family Home the New Alternative to Homeownership?

A new national survey of renters by Opinion Research Corporation dispels myths and answers questions about the future viability of millions of single-family homes owned by real estate investors.

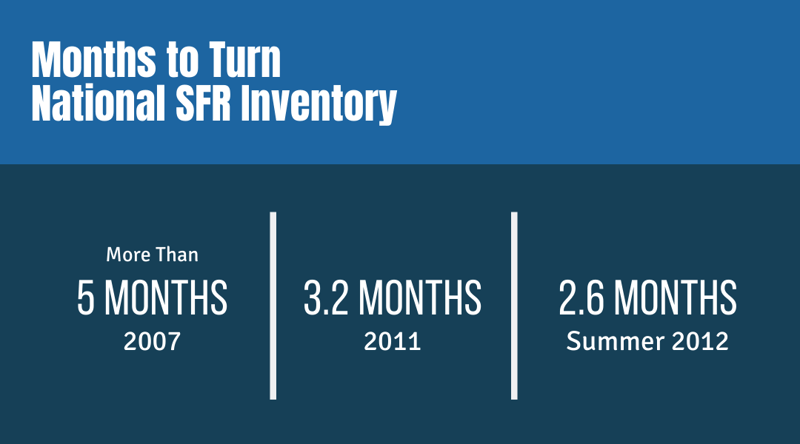

• Is there a stable demand for the growing number of foreclosures converted into rentals?

• Which renters are more stable and likely to stay five years or more, single-family?

• Which are more eager to become homeowners?

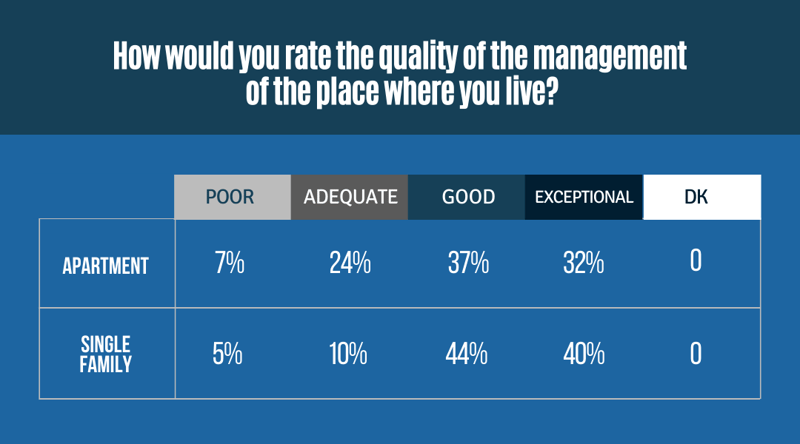

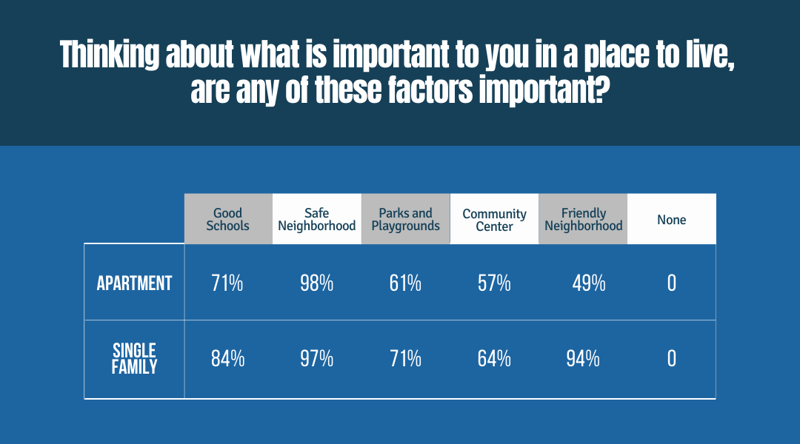

• How are SFR tenants different from apartment dwellers?