Investors Plan To Buy As Many Or More Residential Properties In The Next 12 Months

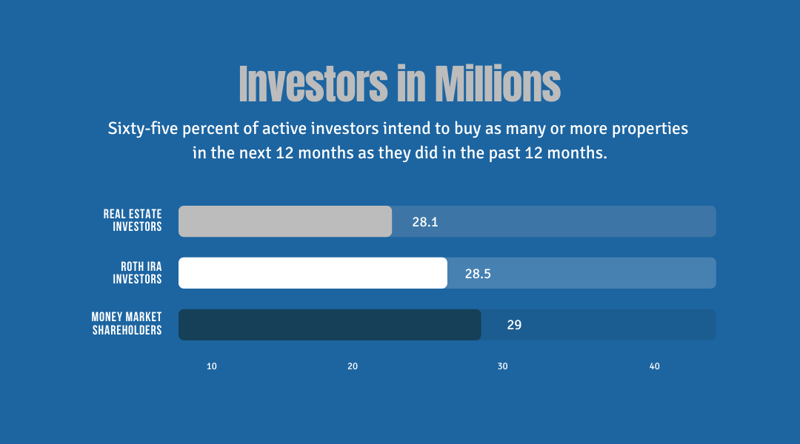

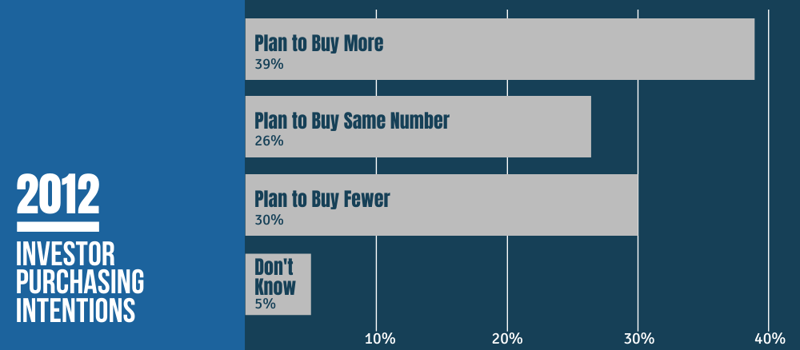

Despite rising prices and shrinking foreclosure inventories, most active real estate investors plan to buy as many or more residential properties in the next 12 months as they did in the past year.

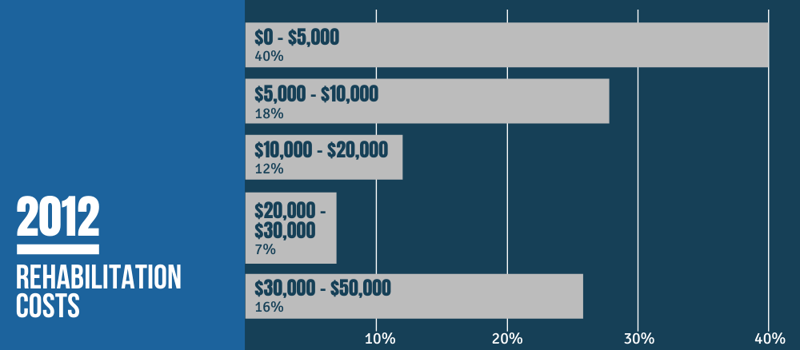

America’s housing crisis generated nearly 4 million foreclosures and devastated residential equity for more than six years, but it also created a powerful new positive force in the nation’s residential real estate economy. Large numbers of individuals and small partnerships saw opportunities to profit from depressed prices and began investing in foreclosures and short sales, buying them at a discount and renovating them, either to sell at a profit or to rent out, often to families that had lost their homes to default. Investors accounted for as many as 25.3 percent of all home sales by May 2012. i

Investors played a critical role in the stabilization of local real estate markets ravaged by foreclosures. When few other buyers would take the risk, investors bought up foreclosures in local markets, restored buyer confidence and began the process of price stabilization, first in shattered Florida markets and then in the Western markets like Phoenix and Las Vegas. Investor-owned homes have established single-family rentals as a 100 billion dollar business and single-family rentals have become so numerous that today they outnumber apartments. ii

The investment potential of foreclosures and short sales now is attracting billion-dollar investments by well-financed partnerships and corporations. Plans are underway to create a new secondary market in securities backed by cash flows from single-family rentals. iii

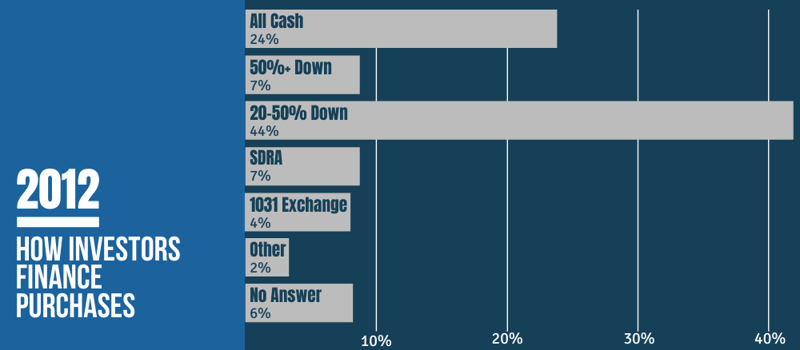

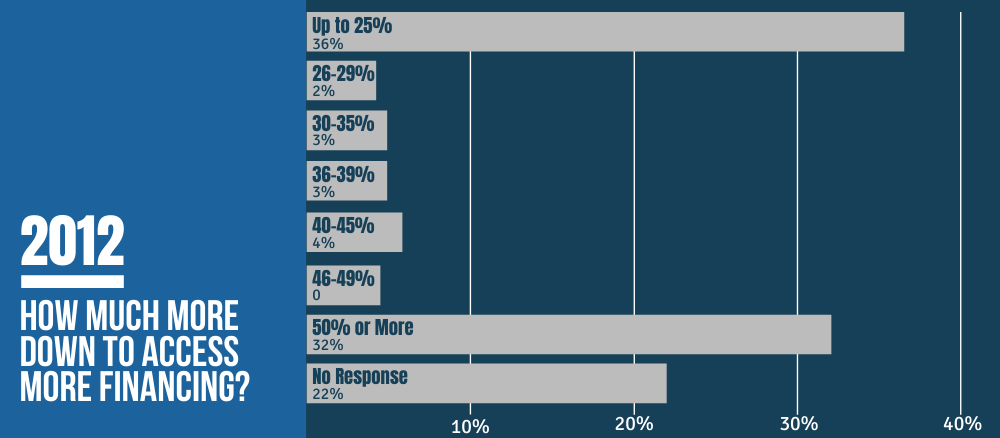

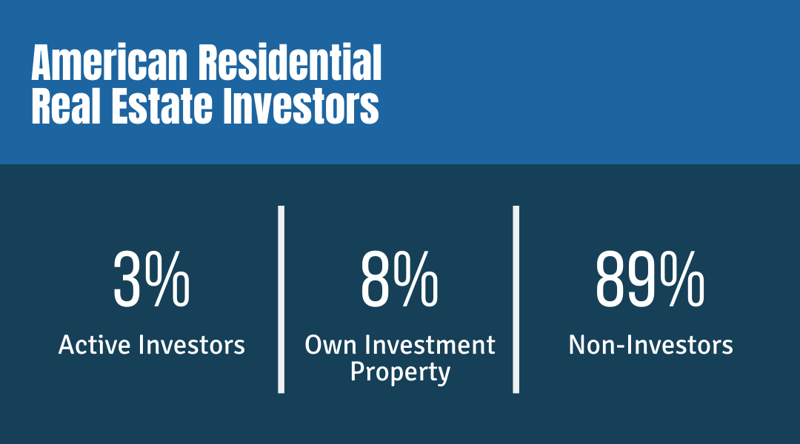

Despite their marketplace impact, little is known about these residential real estate investors. How many are there? How many actively buy and sell properties continuously and how many are more passive, managing one or two at a time? How much do they spend to repair the housing stock damaged by foreclosures that take a year or more to process? How are they financing their transactions and what restrictions limit their activity?

As distress sales decline and prices improve, iv some are questioning the future role of investors. v Will their role diminish or will investors adapt to changing market conditions and continue to augment demand?

To help answer these and other questions, and to validate the role real estate investors are playing in the housing recovery, BiggerPockets.com, the nation’s largest and most active real estate investing social network, and REI Nation, one of the nation's leading providers of single-family rental real estate investment services, joined forces to sponsor a national survey on investor s and their near-term intentions.

ORC International, the leading global market research firm founded in 1938 that conducts the CNN|ORC International poll conducted the Real Estate Investment Realities survey. ORC’s CARAVAN Omnibus used both landline and mobile telephones on August 9-12/16-19/23-26, 2012 among 3036 adults , 1,515 men and 1,521 women 18 years of age and older, living in the continental United States. Some 2,285 interviews were from the landline sample and 751 interviews from the cell phone sample. The margin of error for the survey is +/-03%. All CARAVAN® interviews are conducted using ORC International’s computer assisted telephone interviewing system.

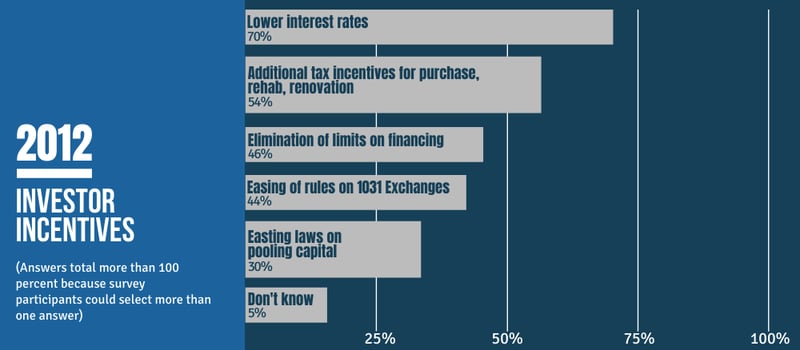

(Answers total more than 100 percent because survey

(Answers total more than 100 percent because survey