Why Should I Invest in Houston Real Estate?

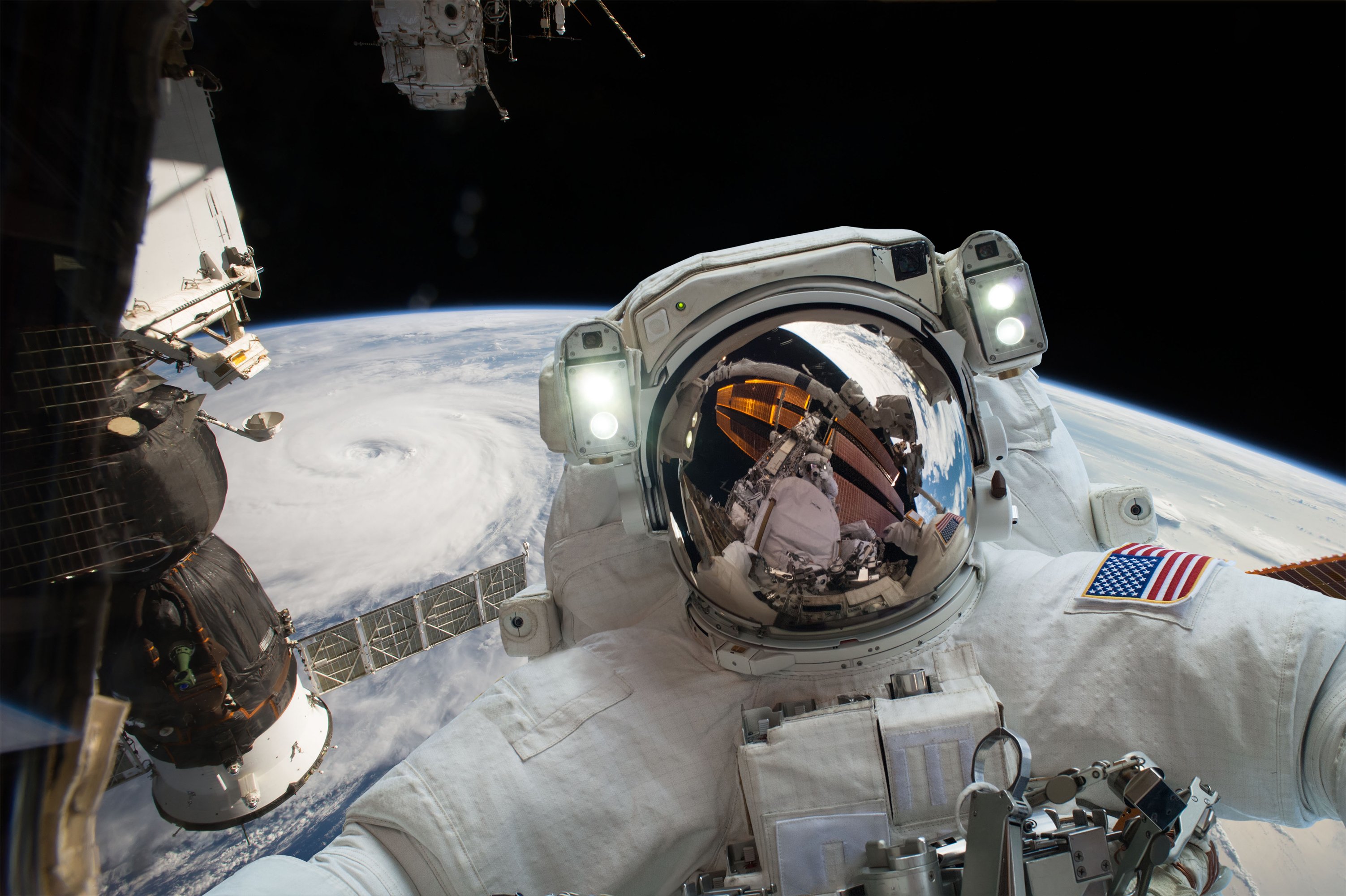

Whether you know it as the home of the Astros, oil tycoons, or the Johnson Space Center, Houston is a city pushing the limits of possibility. Ranking 4th in U.S. city population with 2.3 million residents in the city proper and 6 million residing in the greater metropolitan area, Houston is alive not only with people, but with opportunity.

While the Houston real estate market can be highly competitive and tricky for investors, with a partnership with REI Nation, turnkey real estate investors can rest easy in the security of our expertise in property acquisition, rehabilitation, and management. With us, you can build a passive investment portfolio that includes some of the best investment markets for buy-and-hold investing, bar none.

The job and industry diversification we’ve seen in Houston largely stems from consistent population growth. The facts are clear: people want to live and work in Houston.

In the wake of economic recovery post-Great Recession, Houston saw a surge of 34,000 new residents in a single year. While population growth has slowed to a rate of 1.67 percent per year, this is still above the Texas average of 1.47 percent and leaps and bounds above the national average of 0.71 percent.

Houston has faced its fair share of trials. The oil industry has had bumps in the road that many thought would cause calamity for the market. With economists predicting that its pace of growth could not last, Hurricane Harvey struck. While this was undoubtedly a devastating blow on both a personal and an economic level, Houston demonstrated enormous resilience in the face of adversity.

With a strong, diverse economic backbone it didn’t take long for the city to bounce back. For the real estate investor, seeing a market that can bear the burden of both natural and economic disaster and stand strong on the other side is encouraging in a long-term investment.